The US dollar is the most frequently used currency in the world, with exporters, importers, agencies, and transportation lines. In reality, you’ll see that many expenses, including freight, Terminal Handling Charge (THC), Peak Season Surcharge (PSS), and others, are priced in US dollars. BAF and CAF are two words linked to this topic that will be explained in the next article. Questions such as “What is BAF?”, “What does BAF stand for?”, and “What is CAF?” will be answered in the most direct way possible.

I. BAF

1. Definition of BAF

What does BAF stand for shipping? The Bunker Adjustment Factor is abbreviated as BAF. It’s also known as a ‘Bunker Surcharge’ or a ‘Fuel Adjustment Factor.’ When global oil prices vary, the BAF is imposed on basic ocean freight, which is an automated system that adjusts transport charges in response to variations in fuel costs. These costs account for a sizable portion of the entire cost of shipping products.

As a result, shipping businesses automatically add the necessary amount of gasoline additive to the base rates to avoid repeated changes in the price lists of transport services. BAF is calculated differently by each organization. Freight forwarders also maintain the right to alter the calculating technique at any time without previous notice.

The indicator rises or falls in response to changes in gasoline market prices. It’s commonly determined using PKN Orlen’s average wholesale price for 1 m3 of diesel oil from the preceding month. The frequency with which the rate is updated varies by the entrepreneur; most commonly, it is done weekly or monthly.

The BAF is calculated using the Twenty-foot Equivalent Unit (TEU) and varies depending on the trade routes.

BAF = Fuel Prices x Trade Factor

The trade factor is the average fuel consumption for a certain trade, which varies depending on:

- Route

- Vessel direction

- Distance

- Transit time

- Weight of the load

- Size of the container

- Build of the ship

- Fuel efficiency, etc.

BAF was formerly standardized under the Transpacific Stabilisation Agreement (TSA) on the basis of Brent crude oil. TSA was abolished in 2018 as a result of Maersk Line’s withdrawal as a significant member. Following that, shipping companies began to set their own bunker surcharges, which were supervised by the European Commission.

2. The Kinds of BAF in Sea Freight

The expense of gasoline is distributed in three ways by shippers: ‘fixed BAF,’ ‘floating BAF,’ and ‘locked-in BAF.’ Let’s take a closer look at the differences between these various BAFs.

- Corrected BAF

A set BAF is a fee that must be paid for the bunker regardless of oil price fluctuations. Even if oil prices fluctuate, once the shipper and carrier agree on a price for fixed BAF, it will not be modified. Procurement managers can correctly forecast specific costs, making this a popular BAF alternative.

- Floating BAF

Unlike fixed BAF, floating BAF is affected by changes in oil prices. This approach provides the carrier with reasonable pricing stability since they will not lose any money regardless of how oil prices change. This BAF option reduces shippers’ pricing security because they have no guarantees on the final cost of their transportation.

- Locked-In BAF

The locked-in BAF is the third method, in which both parties agree on a fixed bunker price for a set amount of time. It’s a hybrid of the previous two BAF models, disadvantaging and advantaging various parties based on the price development’s direction. If the price of gasoline falls throughout the contract time of the locked-in BAF, shippers will benefit, but carriers would lose money.

3. In Sea Freight, How is BAF Calculated?

Depending on what their clients want and how oil prices change, ship operators and shipping lines adjust their BAFs in ocean freight on a regular basis, generally monthly, but also yearly or semi-annually. Shipping lines created pricing models for BAFs based on impartial data given by third-party agents to avoid concerns about BAF transparency. Here are some examples of different pricing schemes used by major carriers:

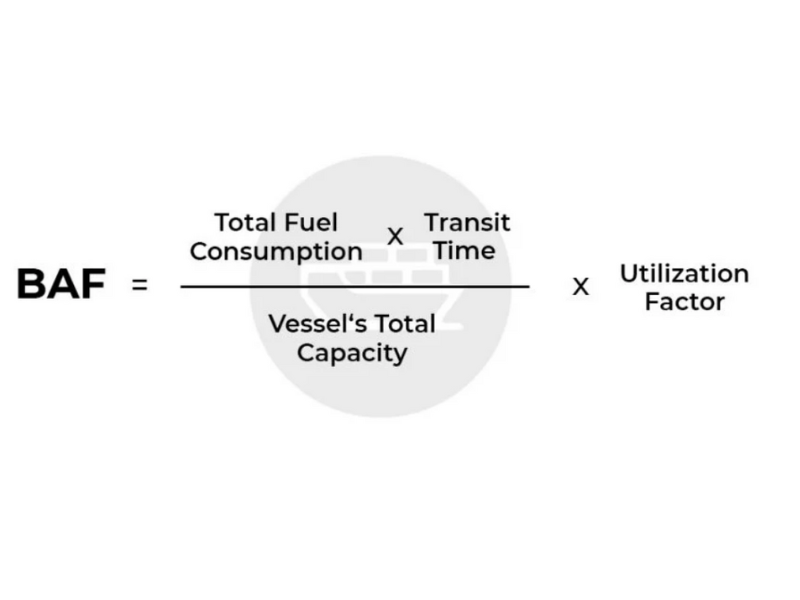

- The BAF formula developed by Maersk

Maersk utilizes the following formula to make its BAF traceable:

(Total Fuel Consumption x Transit Time) / (Vessel’s Total Capacity) x Utilization Factor BAF = (Total Fuel Consumption x Transit Time) / (Vessel’s Total Capacity) x Utilization Factor

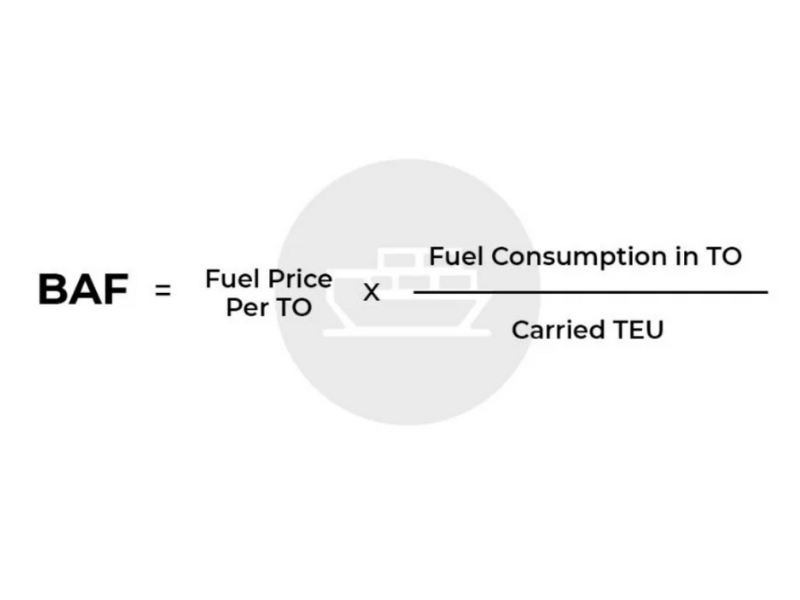

- The BAF formula of Hapag-Lloyd

BAF = (Fuel Consumption in TO) x (Fuel Price Per TO) / Carried TEU

Both formulae are floating BAFs, which means shippers have pricing certainty for their transportations regardless of oil prices. In addition, both organizations compute their new BAF on a quarterly basis. If oil prices hit $45 per ton, Hapag-Lloyd increases this to monthly. This is intended to give a flexible and transparent method without causing unmanageable turmoil if a large number of rates need to be updated. Quarterly rates, on the other hand, may be a logistical nightmare, and with each shipper having its own formula, managing the BAF in procurement is becoming increasingly difficult.

>>Read more: Out of gauge cargo (OOG)

II. CAF

1. Definition of CAF

The Currency Adjustment Factor, a changeable currency supplement, is hidden under this acronym. In a nutshell, CAF is one of the charges applied to basic ocean freight by sea transport operators as a result of ongoing exchange rate fluctuations. The Currency Adjustment Factor (CAF) is used on freight rates to reduce or limit losses or gains due to currency exchange rate variations. CAF is a component of maritime freight that helps to balance and compensate for currency value variations.

It partially covers the freight forwarder’s costs of settling accounts with other transportation market firms in other currencies. Each firm calculates the allowance according to its own methodology and maintains the right to adjust it, just as it does with BAF. This figure is calculated on a regular basis, generally once a month. It might be negative, in which case the freight rate will benefit.

The firm, like BAF, decides on a base rate (it can be, for example, the average exchange rates from several previous months). It gets the CAF value for a specific period based on the difference between the current and the base rate, as well as individually set parameters.

The currency adjustment factor is a percentage fee added to the ocean freight rate. As a result, below is the CAF formula:

Currency Adjusted Freight Rate + Freight Rate + CAF = Freight Rate + CAF

The CAF percentage is compounded by the freight rate to get the currency-adjusted freight rate.

2. CAF Example in Shipping

Let’s look at an export shipment from the United States to Malaysia as an example. The arrangement is door-to-door in this case, with the carrier handling cargo collection, maritime freight, and ultimate delivery.

We presume that the shipment’s term is prepaid and that the shipper has designated the carrier or freight forwarder to handle the entire shipment. The carrier is in charge of making the following arrangements:

- Origin pickup

- Export customs clearance

- Sea freight

- Import customs clearance

- Destination delivery

In this case, the carrier would use a local Malaysian vendor to handle destination tasks such as import customs clearance and ultimate delivery. Because the carrier is paid in the local currency of Malaysian Ringgit (MYR), the shipper in the United States is charged a CAF fee to account for any currency fluctuations between USD and MYR.

3. How to Do a Currency Adjustment Calculation Surcharges on Factors

CAF percentage costs differ according to the carrier, trade channel, and currency pair. Depending on the aforementioned parameters, carriers would charge anywhere from 1% to 10% on average.

To protect against very volatile currencies and unpredictable markets, several carriers have charged more than 50% CAF in the past. Let’s look at an example of how to use the formula to compute the CAF. Assume that the cost of shipping a 40-foot reefer container from New York, the USA to Manila, Philippines is $4,000. The freight forwarder adds a 2.5 percent CAF charge to the consignment.

To calculate the currency-adjusted freight rate, perform the following calculations:

| Charge | Amount | Remarks |

| Ocean Freight | $4,000.00 | Freight charges |

| CAF (2.5%) | +$100.00 | ($4,000.00 x 0.025)= $100.00 |

| Currency Adjusted Freight Rate | =$4,100.00 | Ocean Freight + CAF (%) |

4. How to Avoid Surcharges Due to Currency Adjustment Factors (CAF)?

You may avoid paying a currency adjustment factor premium to your carrier or freight forwarder in numerous ways. Negotiating for “all-inclusive” freight rates is the simplest and most popular method. Despite the fact that carriers may include this in the ocean freight charge, you’ll be able to compare these rates to other market options.

Another option is to pay fees in the base currency. This means that you’ll be charged in US dollars for carrier fees and local fees in local currencies. This would, however, mean that you must have a bank account and cash reserves in the corresponding local currency.

III. The difference between BAF and CAF

BAF and CAF are major surcharges for transportation services. It’s simple to figure out where the genuine pricing rates originate from thanks to a company’s study of their computation. Apart from the definitional differences between BAF and CAF in shipping, the fundamental distinction between BAF and CAF is that BAF is linked to oil prices, whereas CAF is linked to foreign exchange rates.

Conclusion

Many importers may be confused by abbreviations used on freight transportation valuations. Oil price changes and currency volatility are adjusted in BAF and CAF. To better understand where the final price of transportation on our bill comes from, familiarize yourself with the procedures for calculating these costs.

- Website: https://janbox.com.

- Email: [email protected].

- Facebook: https://www.facebook.com/janbox.com.en.