We must remember to verify the current customs rates while importing products from other countries, particularly those outside the European Union. Some terminology, such as HS and HTS, are useful for this purpose. “What is HS code?” and “What is HTS code?” are answered here. As a result, you may learn more about international shipping.

I. What is HS code?

Harmonized System (HS) – the Harmonized Commodity Description and Coding System is the full name of the system. The World Customs Organization (WCO) manages the HS, which is revised every five years. It is the foundation for the import and export classification systems in the United States and many trade partners.

The Harmonized System is a numerical classification system for traded products that is standardized. It is used by customs officials all over the world to identify items and collect statistics for assessing duties and taxes. It includes approximately 5,000 different product categories. This approach is also recognized in more than 200 nations (including the European Union, USA, Japan, and China).

What is HS code?

The Combined Nomenclature (CN) system, which is used in the European Union Customs Tariff, is based on the HS. This system was designed by the World Customs Organization. Its goal is to standardize product categorization and how they are used. The Harmonized System Committee, which is mandated by the World Customs Organization every 5-6 years, modifies the system. On January 1, 2022, the next amendment will take place.

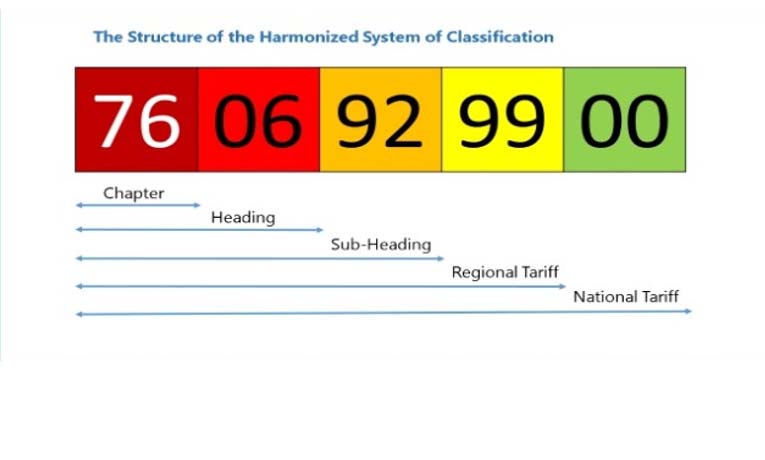

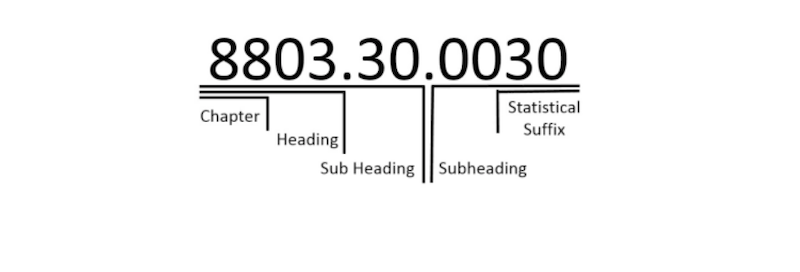

For many classes and commodities, the tariff HS code gives distinct six-digit codes. For additional categorization, countries might add lengthier codes to the first six digits. The United States employs a 10-digit code known as a Schedule B number to categorize items for export, with the first six digits being the HS number. Every physical product, from paper clips to airplanes, has a Schedule B number. The Foreign Trade Division of the United States Census Bureau is in charge of Schedule B.

Nomenclature numbers can be found in the following example:

- Cotton shirts for men and boys (6105 10)

- Telephones for cellular or other wireless networks (8517 12)

II. What is HTS code?

The HTS code meaning is Harmonized Tariff Schedule, which is also known as the United States’ Harmonized Customs Tariff. Its main goal is to classify items that are imported into the United States. This approach also categorizes items depending on their name, application, or construction material. There are about 17,000 different codes, each with eight or 10 digits.

The categorization is published and maintained in various versions by the United States International Trade Commission. The US Customs Service is the designated customs entity for all legally obligatory advice or information. We can also learn about a certain categorization of commodities from them.

The following are some examples of product categorization numbers:

- Medical, veterinary, and dental equipment (9022.21.00)

- Ovens (8417.20.00)

III. The importance of the HS code

1. In order to collect the correct taxes, government agents need to be able to identify items being imported and exported using HS Codes.

HS classification codes may be thought of as the final hurdle that products must overcome before reaching the end of the shipping process. Apart from assisting products in clearing customs, these 6-10 digit numerical Harmonized Tariff Codes serve two important roles and purposes:

- They are used to track things that are imported or exported across a country’s borders.

- They employ a global system to classify and categorize items for customs clearance.

2. Importers and exporters need HS Codes since it is part of their legal obligation to classify their products correctly.

The most critical step for shippers to do before entering the importing and exporting industry is to assign an HS Code. The value of the HS code may be overlooked by importers and exporters. The majority of the time, providers just accept an importer’s purchase orders and send their goods without knowing the HS code of the item. It is not a smart business practice to ship before assigning an HS code since it can lead to major complications that can be expensive, detrimental to both parties’ primary companies, and damaging to one’s image. Here are some of the problems that might arise when HS codes are incorrectly allocated or not assigned at all:

- Impact on Duty Rates: HS codes are inextricably linked to duty rates. It might be highly commercially dangerous not to issue an HS code or to provide an inaccurate HS code. Understanding duty tariffs is a very important part of the shipping procedure. Antidumping and countervailing duties, in addition to ordinary duty rates, are tightly linked to HS codes.

- Importer Security Filing (“10+2”): Providing the HS code for the importer inside the purchase order is one of the most effective ways to comply with Importer Security Filing (“10+2”) regulations.

- Risk of Delays: Shippers may incur delays and storage costs if customs brokers are unable to appropriately categorize a shipment and identify the product and its related HS codes before the vessel arrives and the terminal’s free time expires.

- Regulatory Risk: Shippers are also exposed to regulatory action. Assigning HS codes on the fly is a hazardous proposition that leads to decreased accuracy. Importers who use incorrect HS codes risk paying too much duty or being punished for the error.

3. Every firm in the import and export market, as well as every supply chain, is unique and employs unique business practices.

Both the importer and the exporter have legal obligations to provide the right HS code. Regardless of the variety of items being imported or exported, both parties must ensure that they have included the essential categorization resources and that they take the time to get them properly.

HS code may be found in a variety of places, including:

- Tariffs on imports (aka HTS, Harmonized Tariff Schedule)

- International trade data are collected

- Origins rules

- Internal revenue collection

- Negotiations on trade (e.g., the World Trade Organization schedules tariff concessions)

- Tariffs and data for transportation

- Controlled goods surveillance (e.g., wastes, narcotics, chemical weapons, the ozone layer depleting substances, endangered species)

- Risk assessment, information technology, and compliance are all areas of Customs controls and processes

IV. How to use HS code

During the export procedure, you’ll need both the US Schedule B number and the other country’s version of the HS code for your goods. It’s used to:

- Prepare physical commodities for transportation to a foreign nation by classifying them;

- Report goods with a value of more than $2,500 or that require a license to the Automated Export System (AES);

- Complete any necessary shipping documents, such as the shipper’s letter of instructions, business invoice, or certificate of origin;

- Determine the import tariffs (duties) and whether or not a product qualifies for a preferential tariff under a free trade agreement;

- Conduct market research and gather statistics about the industry;

- Where relevant, follow U.S. law.

V. The easiest way to get HS code

By finding the product, you may search HS code in the correct way. For example, if you wanted to research chocolate confectionery, you’d start by looking for the section and chapter that corresponds to the industry. It would be section 4 (Prepared Foodstuffs) and chapter 18 in this situation (Cocoa and Cocoa Preparations).

You’d then look for the appropriate Heading and Subheading, which would proceed to define your product in further depth. In this scenario, the Heading would be 06 (Chocolate and other food preparations containing cocoa) and the Subheading would be 31 (Chocolate and other food preparations containing cocoa) (Filled).

The HS code is 1806 31 when these numbers are added together. To finish the code, check for the country-specific numbers, which are 0040 in this case (which represents Confectionery in the US). The Schedule B number for chocolate confectionery in the United States is 1806 31 0040 when these numbers are added together.

VI. Schedule B Code & How to identify

The most often used approach for categorizing items is the Schedule B search tool. The website includes training resources and contact information to assist you in identifying your Schedule B number.

The Customs Rulings Online Search System (CROSS) database can assist you in locating your product’s Schedule B classification if it is difficult to categorize. CROSS includes official, legally binding decisions on Schedule B code requests from other exporters and importers. Use this database to see if other exporters or importers have asked for a verdict on the same or comparable goods, and if so, what the decision was.

Some special situations:

- Shipping many products in a single package:

The majority of the time, determining a product’s Schedule B code is simple. For example, an unassembled bicycle supplied in a box including the bicycle frame, handlebars, pedals, and the seat is categorized as a bicycle (since the item is offered as a whole) rather than a collection of individual components. Some sets, on the other hand, are more difficult to categorize. Rule 3 of the Harmonized Tariff Schedule’s General Rules of Interpretation (GRI) deals with composite commodities, mixes, and items offered in a set. In such cases, the GRI has created a three-step method for calculating the Schedule B code; the relevant line is included in the introduction to the official Schedule B publication.

- Textiles/Clothing supplied as a set:

Schedule B codes for textiles and apparel sets have their own set of regulations. For further details, see GRI Chapter 50, Note 14.

Conclusion

Do you have enough information to respond to the question: “What is HS code?”. Product imports and exports between countries throughout the world are rapidly increasing. If you don’t comprehend the words above, you’ll be at a serious disadvantage if you wish to participate in the import-export process. As a result, we hope that this article has given you a better understanding of the HS and HTS codes, as well as other relevant topics.

- Website: https://janbox.com

- Email: [email protected]

- Facebook: https://www.facebook.com/janbox.com.en